The objectives of this article are to explain the relationship between cash flow and other modules in Dynamcis AX 2012 and how to setting forecast cash flows.

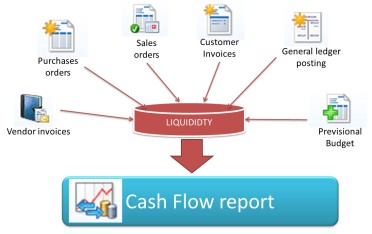

Cash flow is the movement of money into or out of a business (Incomings and outgoings of cash). It is usually measured during a specified, limited period of time. In Dynamics AX, you can use the tools of cash flow forecasts and currency requirements to estimate future availability needs for the company.

For the cash flow forecasts are reliable, functionality must:

- Identify and list all liquidity accounts, which are cash accounts (or equivalent) of the company;

- Identify and configure the forecast transactions that affect liquidity accounts of the company;

- Monitor the level of integration of forecast cash flow selecting parameters for forecasts cash flow;

- Calculate and display forecasts of cash flows;

- Analyze cash flows with a statement of cash flows created by using the financial statement functionality.

Relationship between cash flow and other modules:

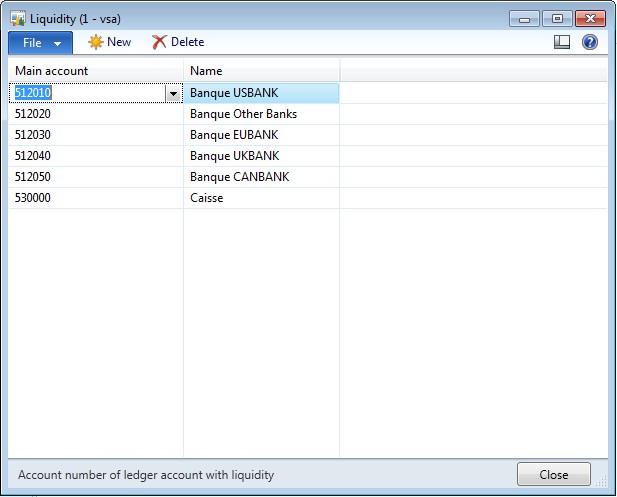

1/ Liquidity accounts

Access : GL > Setup > Posting > Liquidity

Setup all liquidity accounts used for caching cash receipt or cash disbursements: bank accounts, cash accounts, ….

- Click on “New”

- Select the main account

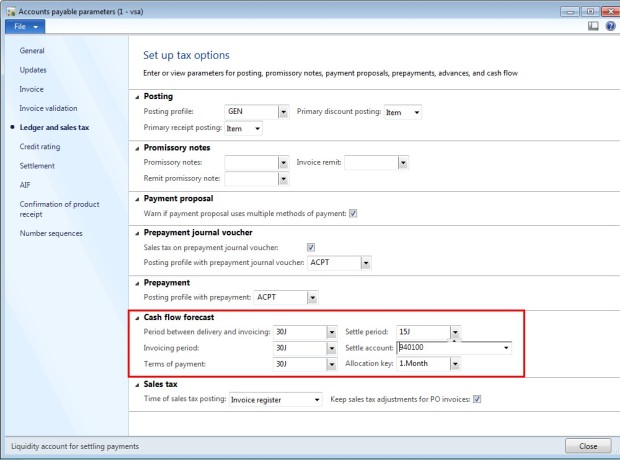

2/ Accounts payable parameters

Access : AP > Setup > AP Parameters > Ledger and Sales tax tab

Set up default values to use on vendors transactions affecting the cash flow.

- Period between delivery and invoicing: select a value that represents the interval between the purchase order delivery date and the expected invoicing of the order.

- Invoicing period: select a value that represents the interval between future purchases transactions and the invoice date

- Terms of payment: select default terms of payment for purchases. This value is used for cash flow calculations except when the terms of payment are specified on the purchase order.

- Settle period: select the value that represents the expected delay between the due date and the date of payment.

- Settle account: select the liquidity account that is the default account to which vendor payments are posted.

- Allocation key: select the value that reduces the effect of the budget in the cash flow forecast as purhase orders are created.

Remark: if the value you need is not available, go to AP > Setup > Payment > Terms of payment to create a new one (or click directly on “View details” when you are in the field).

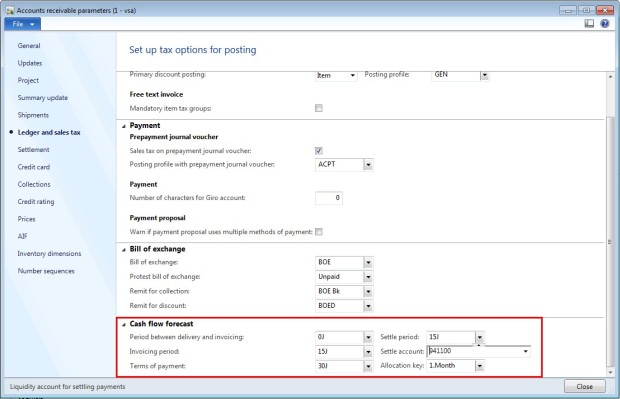

3/ Accounts receivable parameters

Access : AR > Setup > AR Parameters > Ledger and Sales tax tab

Set up default values to use on customers transactions affecting the cash flow.

- Period between delivery and invoicing: select a value that represents the interval between the sales order delivery date and the expected invoicing of the order.

- Invoicing period: select a value that represents the interval between future sales transactions and the invoice date

- Terms of payment: select default terms of payment for sales. This value is used for cash flow calculations except when the terms of payment are specified on the sales order.

- Settle period: select the value that represents the expected delay between the due date and the date of payment.

- Settle account: select the liquidity account that is the default account to which customers payments are posted.

- Allocation key: select the value that reduces the effect of the budget in the cash flow forecast as sales orders are created.

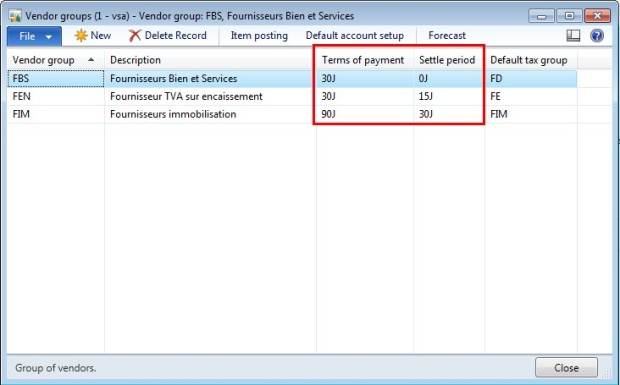

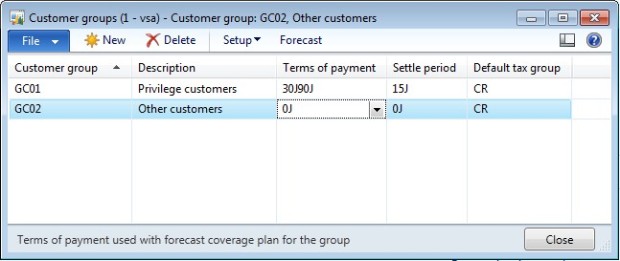

4/ Vendor and Customer groups

Access : AP/AR > Setup > Customer/Vendor > Customer/Vendor group

For the terms of payment and the settle period, it is possible to set up a more specific value for each groups.

- Vendor groups

- Customer groups

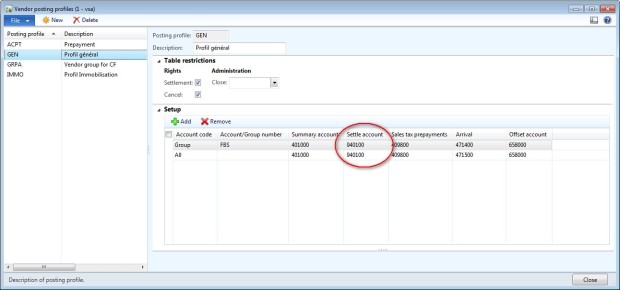

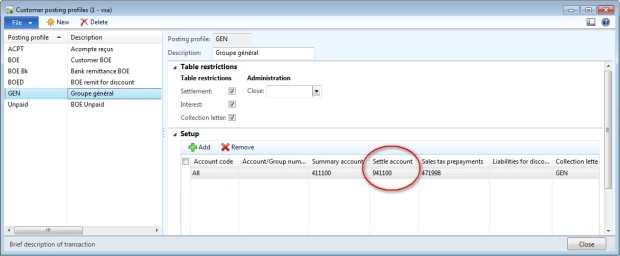

5/ Vendor and Customer posting profiles

Access : AR/AP > Setup > Vendor/Customer posting profiles

For each customer/vendor posting profile, you can select a Settlement account. This account will be used in the financial statement.

- Vendor posting profile

- Customer posting profile

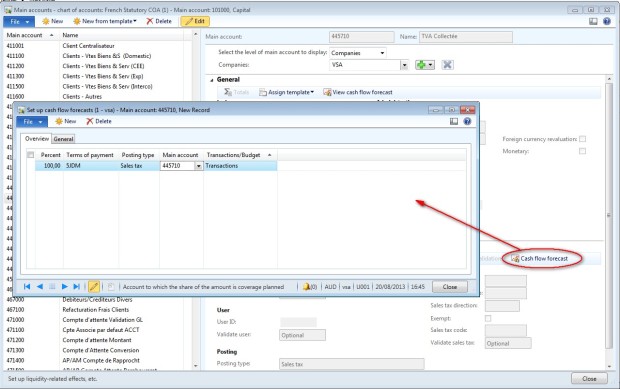

6/ General ledger accounts

Access : GL > Setup > Chart of accounts > Chart of accounts or Common > Main accounts

Some cash flow transactions are not recorded in a purchase order or in an invoice. It is the case for the payment of taxes for example. So you can setup some general ledger accounts to be used in the cash flow forecast.

- Edit the main account.

- Check the level of main account selected is “Companies”.

- Click on “Cash flow forecast” button.

- Select a percent to apply, termos of payment and the main account.

It is also possible to set up a dependent cash flow forecast for a main account that contains transactions that are directly related to transactions in another main account : for more details go to : technet microsoft.

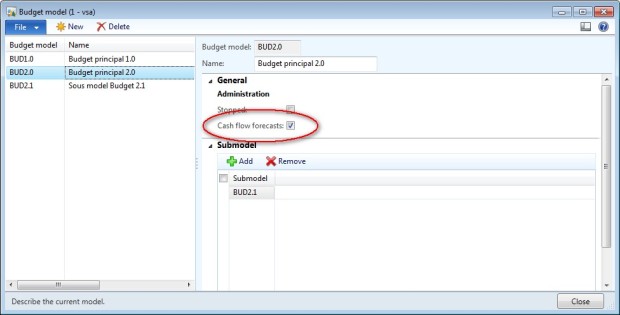

7/ Budget models

Access : Budgeting > Setup > Budgets models

You can include budgets that are created from budget models in cash flow forecasts : If you want the cash flow forecast to include budgets that are based on a specific budget model, select the Cash flow forecasts check box.

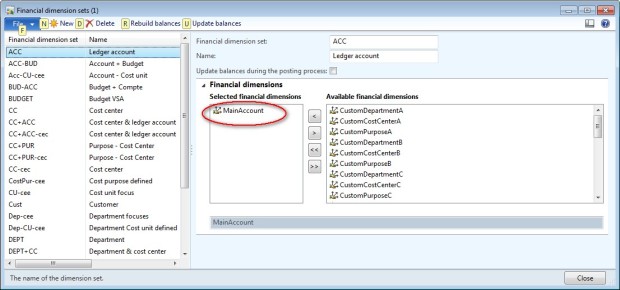

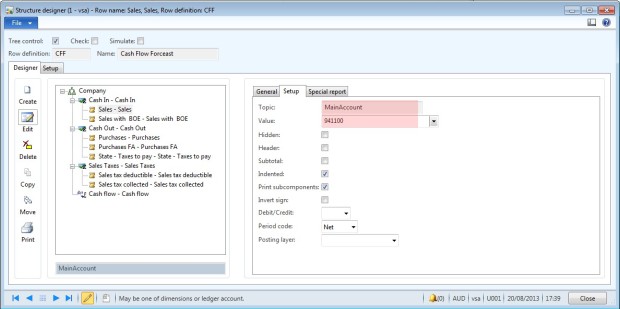

8/ Create a cash flow statement

The last step of the setup is to create a financial statement for the analysis of the cash flow forcast. For more details about the creation of a financial statement, go to this article : Financial statement general setup.

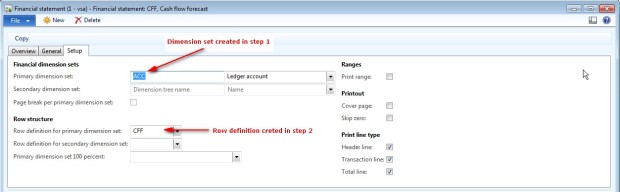

- Step 1: Create a financial dimension step with the main accounts : GL > Setup > Financial dimension > Financial dimension set

- Step 2: Create a row definition with a structure designer that contains all the settle accounts from customer/vendors posting profiles, general accounts with cash flow forecast, and accounts used in budget with forecast. (GL > Setup > Financial statement > Row definition)

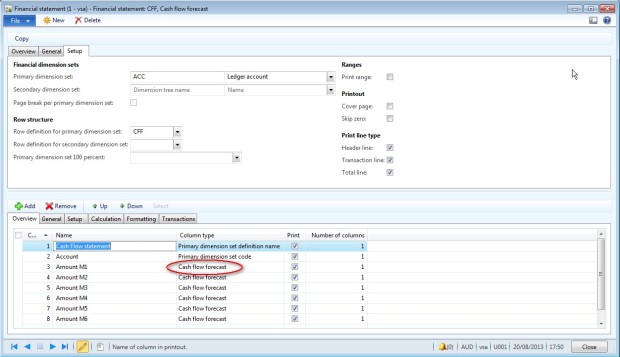

- Step 3: Create a new financial statlement: GL > Setup > Financial statement > Financial Statement

- Step 4: create the column for the cash flow report. (GL > Setup > Financial statement > Financial Statement). Select “Cash flow forecast” to display the cash flow amount.

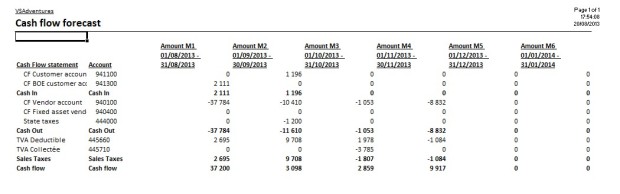

- Example of statement:

9/ Cash flow calculation

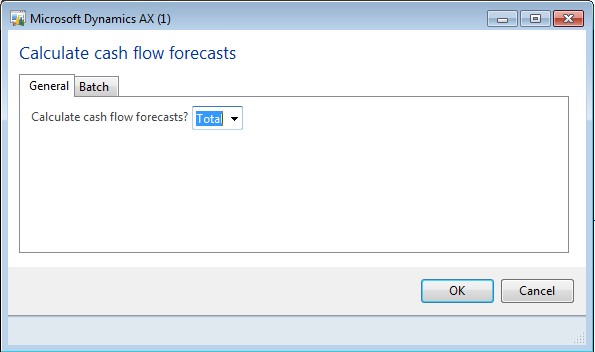

Access : GL > Periodic > Currency requirement > Calculate cash flow forecast

To be able to see cash flow forecast, you must run the “Calculate cash flow forecast” batch.

Select which kind of forecast calculation to perform:

- Total: Clear all cash flow forecast transactions and recalculate. This option is preferred if you have not updated the cash flow forecasts for a long time.

- New: Create a new cash flow forecast, but do not clear other cash flow forecasts. This option lets you investigate, for example, the consequences of budget modifications.

10/ Example of cash flow transaction

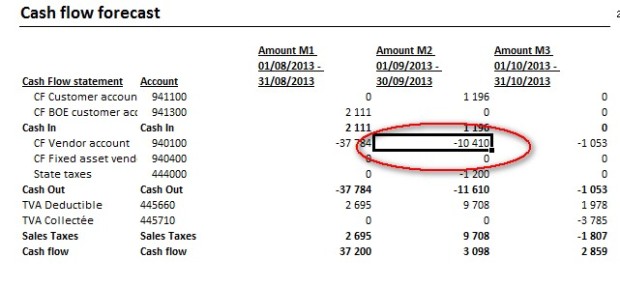

- Vendor account cash flow forecast for period 01/09/2013 to 30/09/2013 = 10 410

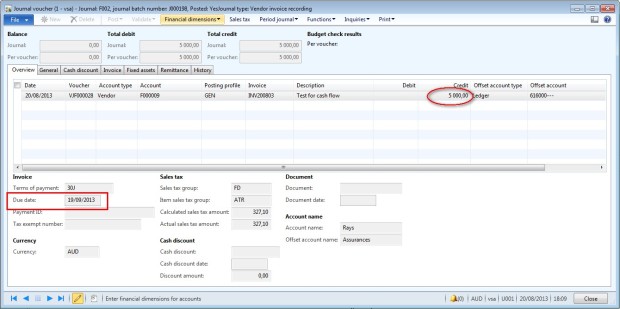

- New vendor invoice : $5000 / Due date = 19/09/2013

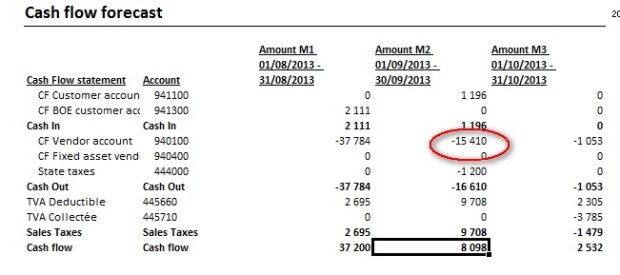

- Generating “Calculate cash flow forecast”

- Display the cash flow report : Vendor transaction cash flow forecast for period 01/09/2013 to 30/09/2013 = 10 410 + 5 000

Hi Violaine ,

Thank you for the post .

I have one question we have the two settle accounts

a) AP/AR parameters – Settle account – 512010/512020.

b) Vendor / Customer Posting profiles – Settle account -940100

What is the difference between these two accounts ?

When we run the calculate cash flow forecast batch job , does system posts any entries to these above defined accounts from backed ?

Without creating the Cashflow Statement , Is there any standard report available in AX (atleast from level ) ?

The settle account in the AR/AP parameter is the default value, used if there is no settle account selected in the posting profile (In my case, I decided to create specific accounts for cash flow and I forget to change those in AP/AR parameters).

The cash flow forecast create only cash flow entries, there is no accounting posted.

For the statement, you can check the standard report (link to technet), but I prefer to use the financial statement because you can create the report you want.

Hi violaine,

Can you tell me the account you used in settle account is not setup in liquidate account setup so why you use other than liquidate account in settle account of vendor and customer profile and last please if it is possible to send me the setup document of cash flow statement print setup as you did above.

Thank

Haris Gillani

Reblogged this on dynamicsaxgeek and commented:

…awesome blog post on AX!

Thanks for the great post!

Pingback: Know How To Forecast Cash flow In D365 – Namith Hosmane's Blog